CAPM Analysis

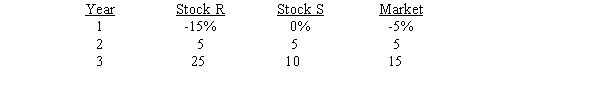

You have been asked to use a CAPM analysis to choose between stocks R and s, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or "the market") is 10%. Your security analyst tells you that Stock S's expected rate of return is = 11%, while Stock R's expected rate of return in = 13%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

-Refer to CAPM Analysis.Calculate both stocks' betas.What is the difference between the betas,i.e.,what is the value of betaR - betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 - Y1) divided by (X2 - X1) may aid you.)

Definitions:

Q1: Because short-term interest rates are much more

Q26: A four-year,zero-coupon Treasury bond sells at a

Q31: Determine the increase or decrease in cash

Q46: The credit period is length of time

Q53: An annuity is a series of equal

Q57: Hillary is trying to determine the cost

Q60: The collection policy refers to the procedures

Q66: Foreign debt is debt sold in a

Q71: The change in net working capital associated

Q83: Which of the following statements is correct?<br>A)