CAPM Analysis

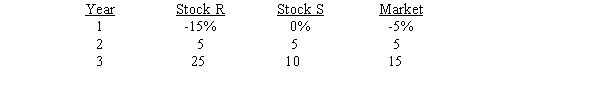

You have been asked to use a CAPM analysis to choose between stocks R and s, with your choice being the one whose expected rate of return exceeds its required rate of by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or "the market") is 10%. Your security analyst tells you that Stock S's expected rate of return is = 11%, while Stock R's expected rate of return in = 13%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

-Refer to CAPM Analysis.Calculate both stocks' betas.What is the difference between the betas,i.e.,what is the value of betaR - betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 - Y1) divided by (X2 - X1) may aid you.)

Definitions:

Aggregate Income

The total sum of income earned by individuals and businesses in an economy over a specified period.

Aggregate Consumption

This refers to the total amount of goods and services consumed by a population or economy over a certain period.

Consumption Function

An economic formula that represents the relationship between total consumption and gross national income.

Aggregate Income

The total income earned by all individuals or entities in an economy, including wages, profits, rents, and investment earnings, over a specific time period.

Q4: A decline in the inventory turnover ratio

Q4: The liquidity preference theory states that each

Q18: You have a chance to purchase a

Q20: A firm is evaluating a new machine

Q22: The optimal capital structure is that capital

Q36: Assume that the State of Florida sold

Q57: Which of the following statements is most

Q58: If $100 is placed in an account

Q61: Two years ago,Targeau Corporation issued BBB rated

Q87: All else equal,a dollar received sooner is