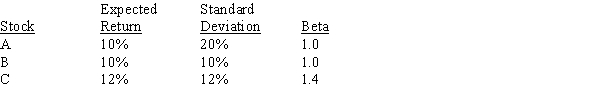

Consider the following information for three stocks,A,B,and C.The stocks' returns are positively but not perfectly positively correlated with one another,i.e.,the correlations are all between 0 and 1.  Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%,and the market is in equilibrium,so required returns equal expected returns.Which of the following statements is CORRECT?

Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%,and the market is in equilibrium,so required returns equal expected returns.Which of the following statements is CORRECT?

Definitions:

Normal Goods

Normal goods are goods for which demand increases as the income of consumers increases, showing a positive relationship between income and demand.

Income Increases

The rise in earnings received by an individual or household, which can impact consumption, savings, and investment behaviors.

Opportunity Cost

Opportunity cost represents the value of the best alternative foregone when a decision is made to choose one option over another.

Optimum

Refers to the best or most favorable condition, value, or level of something.

Q1: Keys Corporation's 5-year bonds yield 6.20% and

Q3: If investors' aversion to risk rose,causing the

Q5: Stock A's beta is 1.5 and Stock

Q8: If the pure expectations theory of the

Q21: We can identify the cash costs and

Q32: Quigley Inc.is considering two financial plans for

Q43: A mutual fund manager has a $40

Q62: Assume that a noncallable 10-year T-bond has

Q85: Refer to Exhibit 10.1.What is the best

Q108: Which of the following statements is CORRECT?<br>A)If