Exhibit 10.1

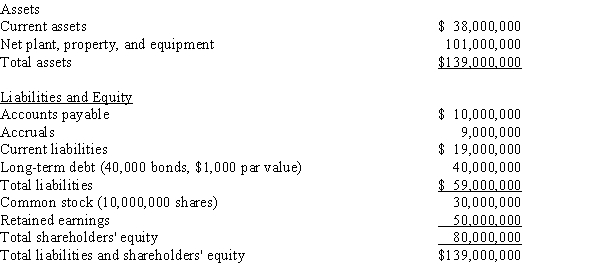

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 10.1.What is the best estimate of the firm's WACC?

Definitions:

Disbursements

Payments made by a business, often related to its operational expenses.

Financing

The process of providing funds for business activities, making purchases, or investing.

Minimum Cash Balance

The lowest amount of cash that a company or individual seeks to maintain on hand to meet immediate expenses.

Raw Material

Basic materials used in the production process, which are transformed into finished goods.

Q27: For a zero-growth firm,it is possible to

Q37: Harry's Inc.is considering a project that has

Q40: Cornell Enterprises is considering a project that

Q44: Eakins Inc.'s common stock currently sells for

Q44: One of the four most fundamental factors

Q46: For a typical firm,which of the following

Q49: Which of the following statement completions is

Q69: Funds acquired by the firm through retaining

Q82: When considering two mutually exclusive projects,the firm

Q94: Which of the following statements is CORRECT?<br>A)Although