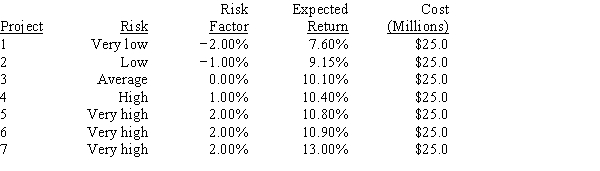

Vang Enterprises,which is debt-free and finances only with equity from retained earnings,is considering 7 equal-sized capital budgeting projects.Its CFO hired you to assist in deciding whether none,some,or all of the projects should be accepted.You have the following information: rRF = 4.50%; RPM = 5.50%; and b = 0.92.The company adds or subtracts a specified percentage to the corporate WACC when it evaluates projects that have above- or below-average risk.Data on the 7 projects are shown below.If these are the only projects under consideration,how large should the capital budget be?

Definitions:

Warranty Expense

The estimated cost of honoring product warranties, which companies recognize to match expenses with related revenues.

Estimated Warranty Costs

Projected expenses that a company expects to incur to repair or replace products during a warranty period.

Estimated Liability

A financial obligation that is expected to occur but has not been finalized in amount or timing.

Warranty Expenses

Costs that a company anticipates for repairing or replacing defective products sold to customers under warranty.

Q20: Assume the following: The real risk-free rate,r*,is

Q22: Which of the following statements is CORRECT?<br>A)One

Q31: Sheehan Inc.is deciding whether to invest in

Q38: Which of the following statements is CORRECT?<br>A)If

Q49: If D<sub>1</sub> = $1.25,g (which is constant)=

Q52: Walter Industries is a family owned concern.It

Q74: If a firm uses the residual dividend

Q80: Firms HD and LD are identical except

Q80: Assuming that their NPVs based on the

Q83: The constant growth DCF model used to