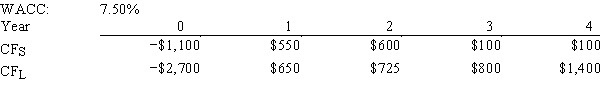

Tesar Chemicals is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV,how much,if any,value will be forgone,i.e.,what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

Definitions:

Free Trade

A policy regime in which governments do not restrict imports from, or exports to, other countries through tariffs, quotas, or other trade barriers.

United States

A country in North America known for its significant influence in global economics, politics, and culture.

Price Of Apples

The cost at which apples are sold, influenced by factors such as seasonality, supply, and demand in the market.

Black Market

A market in which illegal trading takes place at market-determined prices.

Q14: Foley Systems is considering a new investment

Q19: Chicago Brewing has the following data,dollars in

Q29: The cost of debt is equal to

Q37: When estimating the cost of equity by

Q39: Which of the following statements is CORRECT?<br>A)The

Q42: Which of the following statements is CORRECT?

Q51: A conservative financing approach to working capital

Q58: If management wants to maximize its stock

Q63: Suppose the credit terms offered to your

Q67: Which of the following statements is CORRECT?<br>A)The