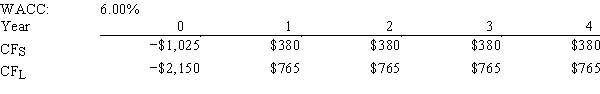

A firm is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO wants to use the IRR criterion,while the CFO favors the NPV method.You were hired to advise the firm on the best procedure.If the wrong decision criterion is used,how much potential value would the firm lose?

Definitions:

Equity Method

An accounting technique used by firms to assess the profits earned by their investments in other companies, by reporting these profits as income.

Common Stock

A type of security that signifies ownership in a corporation and represents a claim on part of the company's profits and assets.

Equity Method

An accounting technique used by a company to record its investment in another company when it has significant influence but not full control over that company.

Q4: Goode Inc.'s stock has a required rate

Q6: Which of the following statements is CORRECT?<br>A)Perhaps

Q10: Banerjee Inc.wants to maintain a target capital

Q12: If a stock's expected return as seen

Q32: Marshall-Miller & Company is considering the purchase

Q34: When the value of the U.S.dollar appreciates

Q36: A firm's collection policy,i.e.,the procedures it follows

Q69: Sub-Prime Loan Company is thinking of opening

Q72: Schalheim Sisters Inc.has always paid out all

Q107: Which of the following statements is CORRECT?<br>A)The