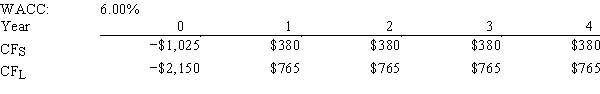

A firm is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO wants to use the IRR criterion,while the CFO favors the NPV method.You were hired to advise the firm on the best procedure.If the wrong decision criterion is used,how much potential value would the firm lose?

Definitions:

Industrialized Economy

An economy characterized by significant industrial activity, high levels of income and employment, and a large manufacturing sector.

Consumption

The act of using goods and services by households or individuals, typically regarded as a primary economic activity.

Production

Production involves the process of creating, manufacturing, or enhancing goods and services.

Consumer Savings

Refers to the amount of money that individuals set aside from their disposable income rather than using it for consumption.

Q12: If a stock's expected return as seen

Q13: Real options can affect the size of

Q17: Which of the following statements is CORRECT?

Q21: If a firm wants to maintain its

Q24: Which of the following is NOT a

Q34: Because "present value" refers to the value

Q40: Traditional discounted cash flow (DCF)analysis--where a project's

Q49: Which of the following statement completions is

Q61: For a stock to be in equilibrium,two

Q79: Which of the following statements is CORRECT?<br>A)A