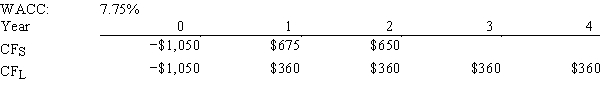

Kosovski Company is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and are not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

Definitions:

Developmental Coordination Disorder

is a chronic neurological condition characterized by poor coordination and clumsiness, often diagnosed in childhood and affecting the development of motor skills.

Expressing Himself

The act of conveying thoughts, feelings, or ideas through speech, writing, or other forms of communication.

Intellectual Disability

A developmental disorder characterized by limitations in both intellectual functioning (such as learning, problem-solving, judgment) and in adaptive behavior.

Down Syndrome

A genetic disorder caused by the presence of all or part of a third copy of chromosome 21, characterized by physical growth delays and intellectual disabilities.

Q4: Goode Inc.'s stock has a required rate

Q6: Which of the following statements is CORRECT?<br>A)If

Q8: It is not possible for abandonment options

Q13: The capital intensity ratio is generally defined

Q25: If a firm practices capital rationing,this means

Q31: Opportunity costs include those cash inflows that

Q40: S.Bouchard and Company hired you as a

Q56: Data on Shick Inc.for 2013 are shown

Q62: Which one of the following would NOT

Q126: Cass & Company has the following data.What