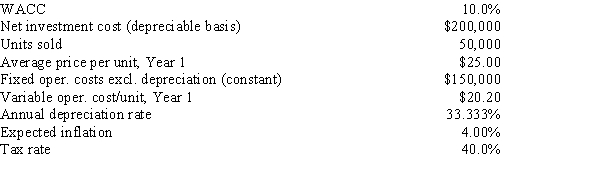

Poulsen Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.No change in net operating working capital would be required.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate,but the CFO thinks an inflation adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made versus if it is not made?

Definitions:

Central Nervous System

The part of the nervous system that includes the brain and spinal cord, responsible for processing and transmitting messages throughout the body.

Peripheral Nervous System

The part of the nervous system outside the brain and spinal cord, consisting of nerves and ganglia, that connects the central nervous system to limbs and organs.

Physiology Of Stress

The study of how the body responds physically and biologically to stressors, including the activation of the nervous system and the release of stress hormones.

Stress Reactions

Physical, mental, and emotional responses to perceived threats or challenges.

Q29: Which of the following statements is CORRECT?<br>A)A

Q29: Dye Industries currently uses no debt,but its

Q46: Preferred stock typically has a par value,and

Q50: A firm buys on terms of 2/8,net

Q64: A firm should never accept a project

Q65: A "reverse split" reduces the number of

Q66: Which of the following should be considered

Q70: The before-tax cost of debt,which is lower

Q81: Carter's preferred stock pays a dividend of

Q113: Calculate the required rate of return for