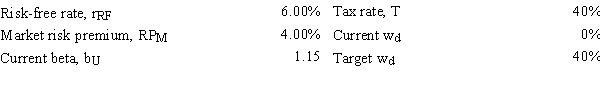

Dye Industries currently uses no debt,but its new CFO is considering changing the capital structure to 40.0% debt (wd) by issuing bonds and using the proceeds to repurchase and retire common shares so the percentage of common equity in the capital structure (wc) = 1 − wd.Given the data shown below,by how much would this recapitalization change the firm's cost of equity,i.e.,what is rL − rU?

Definitions:

Leverage Ratio

A financial metric used to assess a company's ability to meet its financial obligations, calculated as the ratio of its total debt to its equity, assets, or other benchmarks.

Bank Capital

The financial resources held by a bank that acts as a cushion against potential losses, consisting of equity, retained earnings, and other reserves.

Assets

Resources owned by a person or company, regarded as having value and available to meet debts, commitments, or legacies.

Discount Rate

The interest rate charged to commercial banks and other depository institutions on loans received from the central bank's discount window.

Q4: Which of the following statements is CORRECT?<br>A)If

Q12: Chua Chang & Wu Inc.is planning its

Q35: High Roller Properties is considering building a

Q43: Your company,RMU Inc.,is considering a new project

Q45: Mansi Inc.is considering a project that has

Q57: NY Fashions has the following data.If it

Q62: Firms U and L each have the

Q79: Assume that the economy is in a

Q89: Duval Inc.uses only equity capital,and it has

Q92: Which of the following statements is CORRECT?<br>A)Shorter-term