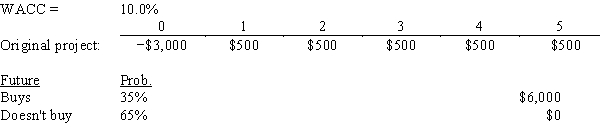

Tutor.com is considering a plan to develop an online finance tutoring package that has the cost and revenue projections shown below.One of Tutor's larger competitors,Online Professor (OP) ,is expected to do one of two things in Year 5: (1) develop its own competing program,which will put Tutor's program out of business,or (2) offer to buy Tutor's program if it decides that this would be less expensive than developing its own program.Tutor thinks there is a 35% probability that its program will be purchased for $6 million and a 65% probability that it won't be bought,and thus the program will simply be closed down with no salvage value.What is the estimated net present value of the project (in thousands) at a WACC = 10%,giving consideration to the potential future purchase?

Definitions:

Financial Distress

A condition where a firm finds it challenging or impossible to cover its financial commitments to lenders.

M&M Proposition II

A theory in corporate finance that suggests the cost of equity increases with higher debt levels, keeping the company's value unchanged if taxes are not considered.

Financial Risk

The hazard of suffering financial loss through an investment or business endeavor.

Business Risk

encompasses the potential for a firm's operational or financial performance to suffer due to internal or external factors, impacting profitability and viability.

Q2: For planning purposes,managers must forecast the total

Q7: Noe Drilling Inc.is considering Projects S and

Q8: Aggarwal Inc.buys on terms of 2/10,net 30,and

Q16: Net operating working capital,defined as current assets

Q27: In theory,reducing the volatility of its cash

Q32: Leasing is typically a financing decision and

Q55: Stock A has a beta of 0.8

Q60: Sheehan Corp.is forecasting an EPS of $3.00

Q74: Which of the following statements is CORRECT,assuming

Q99: The NPV method's assumption that cash inflows