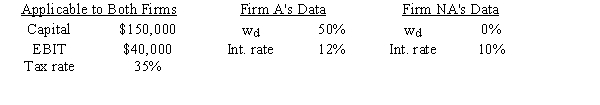

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical⎯they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e.,what is ROEA − ROENA?

Definitions:

Defined-Benefit Plan

A type of retirement plan where the employer guarantees a specific retirement benefit amount for the employee based on a formula.

Predetermined Formula

A specific method set in advance for calculating a particular outcome or value.

Time Not Worked

Periods during an employee's scheduled work hours in which they are not engaged in productive work due to breaks, downtime, or absences.

Discretionary

Refers to actions or decisions that are left to an individual's judgment or choice, without strict necessity or guidelines.

Q6: Gekko Properties is considering purchasing Teldar Properties.Gekko's

Q10: Refer to Exhibit 7A.1.What is the expected

Q13: Modigliani and Miller (MM),in their second article,took

Q17: Sensitivity analysis measures a project's stand-alone risk

Q19: Which of the following events is likely

Q22: FAS 13 requires that for an unqualified

Q24: Which of the following statements is CORRECT?<br>A)Sensitivity

Q34: Since the primary rationale for any operating

Q34: When the value of the U.S.dollar appreciates

Q36: Which of the following statements is CORRECT?<br>A)When