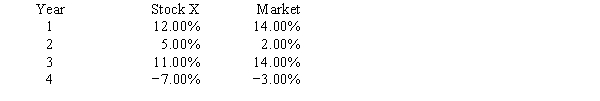

Stock X and the "market" have had the following rates of returns over the past four years. 60% of your portfolio is invested in Stock X and the remaining 40% is invested in Stock Y.The risk-free rate is 6% and the market risk premium is also 6%.You estimate that 14% is the required rate of return on your portfolio.What is the beta of Stock Y?

Definitions:

Q3: The Quick Company expects its sales to

Q8: Which of the following would be most

Q8: At the beginning of the year,you purchased

Q24: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" Refer to the

Q26: As a firm's sales grow,its current assets

Q35: Fauver Industries plans to have a capital

Q61: Your consulting firm was recently hired to

Q85: The infant industry argument for tariffs is

Q100: Economists agree that corporations always shift the

Q124: When the distribution of income is adjusted