Exhibit 8A.1

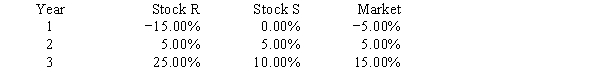

You have been asked to use a CAPM analysis to choose between Stocks R and S, with your choice being the one whose expected rate of return exceeds its required return by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or the "market") is 10%. Your security analyst tells you that Stock S's expected rate of return is equal to 11%, while Stock R's expected rate of return is equal to 12%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return:

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

-Refer to Exhibit 8A.1.Set up the SML equation and use it to calculate both stocks' required rates of return,and compare those required returns with the expected returns given above.You should invest in the stock whose expected return exceeds its required return by the widest margin.What is the widest positive margin,or greatest excess return (expected return − required return) ?

Definitions:

Steel

A strong, hard metal made of iron and carbon, and often other elements, used extensively in construction and manufacturing.

Domestic Quantity

The total amount of a good or service produced within a country's borders, available for consumption or export.

Supplied

Refers to the total amount of a good or service that is available to consumers in a market at a given price level.

CD-Rom Drives

Hardware devices used to read and sometimes write data to CD-ROM discs, prevalent in computing before cloud storage and USB.

Q1: A company seeking to fight off a

Q8: Aggarwal Inc.buys on terms of 2/10,net 30,and

Q9: A call option whose underlying stock value

Q16: Kohers Inc.is considering a leasing arrangement to

Q40: Which of the following statements is CORRECT?<br>A)One

Q47: Suppose one British pound can purchase 1.82

Q73: Comparative advantage can result from different climates,natural

Q85: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" Refer to the

Q133: In considering euros and dollars,the rates of

Q147: Which is an example of a change