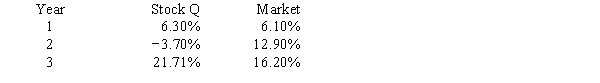

Given the following returns on Stock Q and "the market" during the last three years,what is the difference in the calculated beta coefficient of Stock Q when Year 1 and Year 2 data are used as compared to Year 2 and Year 3 data? (Hint: Think rise over run.)

Definitions:

Q15: Which organization meets regularly to establish rules

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" In which of

Q31: The fact that long-term debt and common

Q35: A riskless hedge can best be defined

Q46: Miller and Modigliani's dividend irrelevance theory says

Q75: Companies HD and LD have identical tax

Q86: Which of the following will generate a

Q98: The U.S.supply of Japanese yen is:<br>A) downsloping

Q104: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" Refer to the

Q119: Other things equal,a tariff is:<br>A) superior to