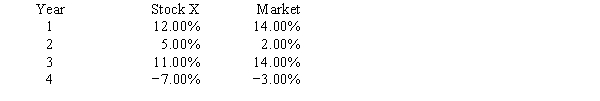

Stock X and the "market" have had the following rates of returns over the past four years. 60% of your portfolio is invested in Stock X and the remaining 40% is invested in Stock Y.The risk-free rate is 6% and the market risk premium is also 6%.You estimate that 14% is the required rate of return on your portfolio.What is the beta of Stock Y?

Definitions:

Delivery Cues

Nonverbal signals or behaviors used by a speaker to emphasize points, manage the pace, or engage the audience during a presentation.

Stage Directions

Instructions in the script of a play that tell actors how to enter, where to stand, how to move, and so on.

Preview Section

A part of a document or presentation that provides a brief overview or summary of the content that will follow.

Credibility

The quality of being trusted and believed in, often based on a track record of reliability and honesty.

Q7: The TANF program:<br>A) is a form of

Q12: A warrant is an option,and as such

Q14: Taxable income is:<br>A) total income less deductions

Q23: A factor that serves as the economic

Q26: Government programs that replace earnings lost when

Q40: Taxes and transfer payments:<br>A) reduce the degree

Q46: Which is an example of a change

Q58: Using income as the tax base,which of

Q96: The best example of a land-intensive commodity

Q122: If the exchange rate between the U.S.dollar