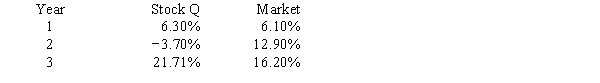

Given the following returns on Stock Q and "the market" during the last three years,what is the difference in the calculated beta coefficient of Stock Q when Year 1 and Year 2 data are used as compared to Year 2 and Year 3 data? (Hint: Think rise over run.)

Definitions:

Lev Vygotsky

A Russian psychologist who developed theories on social cognitive development, emphasizing the role of social interactions and cultural tools in the development of thinking and learning.

Logical Principles

Fundamental concepts that underpin valid reasoning and the structure of logical arguments.

Jean Piaget

A Swiss psychologist known for his pioneering work in child development, specifically his theory of cognitive development stages.

Asthma

A chronic disease of the respiratory system in which inflammation narrows the airways from the nose and mouth to the lungs, causing difficulty in breathing. Signs and symptoms include wheezing, shortness of breath, chest tightness, and coughing.

Q10: Banerjee Inc.wants to maintain a target capital

Q11: An investor who "writes" a call option

Q11: A lockbox plan is<br>A)used to protect cash,

Q12: The data on the distribution of personal

Q20: Numerous historical examples suggest that free trade

Q36: Most convertible securities are bonds or preferred

Q38: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" Refer to the

Q56: Portland Plastics Inc.has the following data.If it

Q75: Other things equal,economists would prefer:<br>A) free trade

Q96: A firm constructing a new manufacturing plant