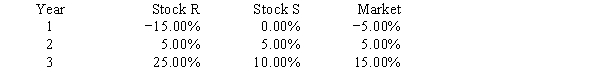

Exhibit 8A.1

You have been asked to use a CAPM analysis to choose between Stocks R and S, with your choice being the one whose expected rate of return exceeds its required return by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or the "market") is 10%. Your security analyst tells you that Stock S's expected rate of return is equal to 11%, while Stock R's expected rate of return is equal to 12%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return:

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

-Refer to Exhibit 8A.1.Set up the SML equation and use it to calculate both stocks' required rates of return,and compare those required returns with the expected returns given above.You should invest in the stock whose expected return exceeds its required return by the widest margin.What is the widest positive margin,or greatest excess return (expected return − required return) ?

Definitions:

Net Investment Income

The profit gained from investment activities after subtracting all related expenses, such as fees and taxes.

Assets Abroad

Financial holdings or investments located in foreign countries, outside of an investor's home country.

Current Account Deficit

A measurement of a country’s trade where the value of the goods and services it imports exceeds the value of the products it exports.

Capital Account

A national account that records transactions involving the purchase and sale of assets, including real estate, stocks, bonds, and businesses, between residents and non-residents.

Q9: A detachable warrant is a warrant that

Q36: Which of the following statements is CORRECT?<br>A)When

Q41: Currently,a U.S.trader notes that in the 6-month

Q42: In 2009,the United States provides about 8.5

Q49: If an investor can obtain more of

Q51: A progressive tax takes relatively more from

Q57: One main complaint about the official income

Q58: If management wants to maximize its stock

Q60: The Temporary Assistance to Needy Families program

Q67: A 100% stock dividend and a 2:<br>1