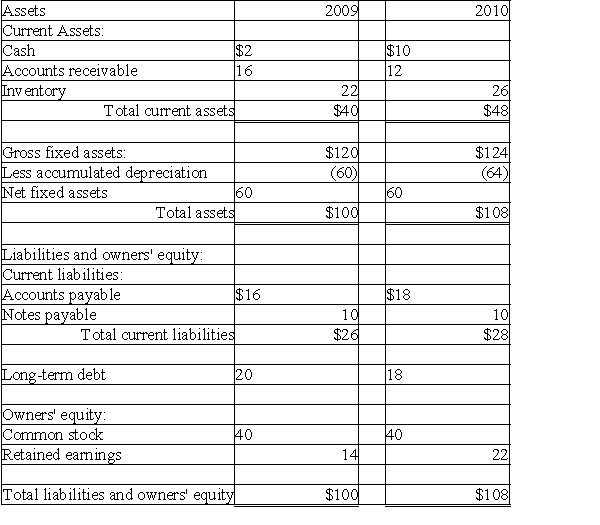

Please refer to Table 4-7 for the following question.

Table 4-7

Hokie Corporation Comparative Balance Sheet

For the Years Ending December 31, 2009 and 2010

(Millions of Dollars)

Hokie had net income of $28 million for 2010 and paid total cash dividends of $20 million to their common stockholders.

Hokie had net income of $28 million for 2010 and paid total cash dividends of $20 million to their common stockholders.

-Calculate the following 2010 financial ratios of Hokie Corporation using the information given in Table 4-7:

i.current ratio

ii.acid test ratio

iii.debt ratio

iv.return on total assets

v.return on common equity

Definitions:

Interests Consideration

The act of taking into account various interests, preferences, and perspectives when making decisions or developing policies.

Q5: Accounting rules specify that assets on the

Q36: Which of the following represents the correct

Q57: A 65 year-old man is retiring and

Q64: You are ready to retire.A glance at

Q70: Which of the following accounts does not

Q77: General Motors raises money by selling a

Q82: An example of a primary market transaction

Q99: The astute financial manager will seek to

Q105: A company with a bond rating of

Q117: Bankers Corp has a very conservative Beta