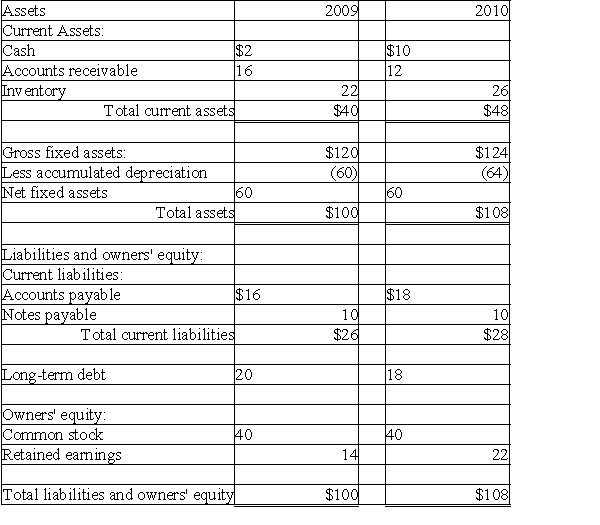

Please refer to Table 4-7 for the following question.

Table 4-7

Hokie Corporation Comparative Balance Sheet

For the Years Ending December 31, 2009 and 2010

(Millions of Dollars)

Hokie had net income of $28 million for 2010 and paid total cash dividends of $20 million to their common stockholders.

Hokie had net income of $28 million for 2010 and paid total cash dividends of $20 million to their common stockholders.

-Calculate the following 2010 financial ratios of Hokie Corporation using the information given in Table 4-7:

i.current ratio

ii.acid test ratio

iii.debt ratio

iv.return on total assets

v.return on common equity

Definitions:

Clear And Present Danger

A doctrine used to test whether limitations may be placed on First Amendment freedoms of speech, press, or assembly when the exercise of these rights presents an immediate danger.

Affirmative Action

Policies or measures that favor individuals belonging to groups known to have been discriminated against previously, often related to education and employment.

Future Sum

The amount of money or value to be received or paid at a specified date in the future.

Interest Rate

The fee, represented as a fraction of the initial sum, that a creditor levies on a debtor for asset utilization.

Q48: A bond with a par value of

Q49: Shafer Corporation issued callable bonds.The bonds are

Q51: Which form of organization is free of

Q68: Table 3-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2782/.jpg" alt="Table 3-3

Q68: A bond issued by Barney,Inc.10 years ago

Q74: Bill saves $3,000 per year in his

Q80: The statement of cash flow explains the

Q95: The current rate of return on a

Q120: Suppose interest rates have been at historically

Q141: The date today is January 1,2010.A one-year