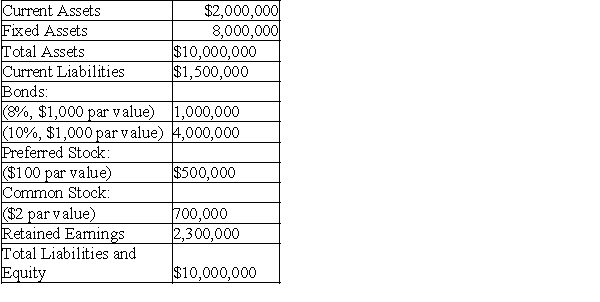

The MAX Corporation is planning a $4,000,000 expansion this year.The expansion can be financed by issuing either common stock or bonds.The new common stock can be sold for $60 per share.The bonds can be issued with a 12 percent coupon rate.The firm's existing shares of preferred stock pay dividends of $2.00 per share.The company's corporate income tax rate is 46 percent.The company's balance sheet prior to expansion is as follows:

MAX Corporation

a.Calculate the indifference level of EBIT between the two plans.

a.Calculate the indifference level of EBIT between the two plans.

b.If EBIT is expected to be $3 million,which plan will result in higher EPS?

Definitions:

Interdependencies

Mutual reliance between entities, where the actions or outcomes of one entity depend on those of another.

Organizational Processes

Entails the methods, procedures, and routines used within an organization to produce and deliver its products or services.

External Acquisition

External acquisition refers to the process by which a company or organization purchases or acquires another company, assets, or significant shares from outside its current operations to expand its business.

Relevant Expertise

Specialized knowledge or skills that are directly applicable to a specific task or situation.

Q20: Rent-to-Own Equipment Co.is considering a new inventory

Q36: Which of the following methods of evaluating

Q39: John Q.Enterprises is considering two potential investments.The

Q65: The profitability index is the ratio of

Q67: Rent-to-Own Equipment Co.is considering a new inventory

Q68: Given the following information on S &

Q69: The inclusion of a compensating balance requirement

Q89: A corporation announces a significant increase in

Q102: Issuing new short-term bonds to finance an

Q115: If sales double,the break-even model assumes that