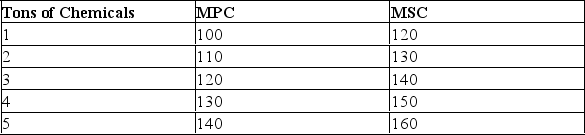

The following table shows the marginal private cost (MPC)and the marginal social cost (MSC)of a chemical factory.

Answer the following questions:

Answer the following questions:

(1)What is the marginal cost of the factory's externality? Is it constant at all quantities?

(2)If the factory is a perfectly competitive firm and is not required by the government to internalize its external cost,how many tons should the factory produce,given that the market price of a ton of chemicals is $130?

(3)If the factory is a perfectly competitive firm and is required by the government to internalize its external cost,how many tons should the factory produce,given that the market price of a ton of chemicals is $130?

(4)Draw a graph illustrating your answers.

Definitions:

Fixed Manufacturing Overhead

Expenses related to manufacturing that remain constant regardless of the level of production, such as building lease payments and equipment depreciation.

Deferred Inventories

Inventory costs that are not expensed in the period they are incurred but are deferred to a future period.

Absorption Costing

This accounting practice involves adding all costs associated with production, including direct materials, labor, and both kinds of overhead expenses (variable and fixed), into the cost calculation of a product.

Unit Product Cost

The total cost (fixed and variable) associated with making one unit of product.

Q16: What are normal profits?<br>A)The minimum profit that

Q21: The size of Canada's labour force has

Q23: Use Table 6.6 to answer this question.Assuming

Q47: Describe three ways in which a union

Q74: "If MP is falling than AP must

Q103: Refer to Figure 10.10 to answer this

Q109: Differentiate between a firm and an industry.

Q115: Refer to the information above to answer

Q129: Refer to the information above to answer

Q147: All of the following,except one,are true at