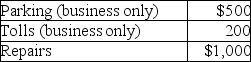

Chelsea,who is self-employed,drove her automobile a total of 20,000 business miles in 2017.This represents about 75% of the auto's use.She has receipts as follows:  Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method.After application of any relevant floors or other limitations,she can deduct

Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method.After application of any relevant floors or other limitations,she can deduct

Definitions:

Childhood Friends

Long-term friendships that begin in childhood, often characterized by high levels of trust and shared experiences.

Work Friends

Refers to friendships that develop in the workplace between colleagues, which can affect job satisfaction and productivity.

Observational Learning

The acquisition of behavior based on the observation of another person’s behavior and of its consequences for that person. Also known as modeling.

Instrumental Conditioning

The process through which an individual learns a behavior in response to a stimulus to obtain a reward or avoid a punishment.

Q3: Potential investments include all of the following

Q13: Compounding is the process of obtaining present

Q30: The Present Value Interest Factor (PVIF)becomes lower

Q53: Byron is investigating a mutual fund that

Q55: Marcia,who is single,finished graduate school this year

Q71: Generally,Section 267 requires that the deduction of

Q87: List four types of financial institutions that

Q92: Tasneem,a single taxpayer has paid the following

Q107: Edward incurs the following moving expenses: <img

Q129: Dighi,an artist,uses a room in his home