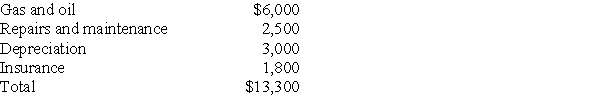

Sarah purchased a new car at the beginning of the year.She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2017 for employment-related business miles.She incurs the following expenses related to both business and personal use:

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Definitions:

Gender Identity

A personal conception of oneself as male, female, a blend of both, or neither, which can correspond with or differ from one's sex assigned at birth.

Transgender Health

The holistic medical and psychological care tailored to the specific needs of transgender individuals.

Gender Dysphoria

A psychological condition where there is a significant distress or discomfort due to a mismatch between an individual's gender identity and their assigned sex at birth.

DSM-5

stands for Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition, which is a manual for the assessment and diagnosis of mental disorders.

Q45: Donald sells stock with an adjusted basis

Q52: Which of the following is not a

Q75: Constance,who is single,is in an automobile accident

Q81: During the current year,Ivan begins construction of

Q82: Emeril borrows $340,000 to finance taxable and

Q95: Medical expenses are deductible as a from

Q98: Classification of a loss as a capital

Q103: Losses from passive activities that cannot be

Q113: Which of the following is not required

Q131: When a public school system requires advanced