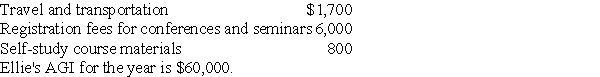

Ellie,a CPA,incurred the following deductible education expenses to maintain or improve her skills:

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by her employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

Definitions:

Judge or Magistrate

Officials with the authority to conduct court proceedings, make legal decisions, and rule on legal matters.

Grand Jury

A legal body empowered to conduct official proceedings to investigate potential criminal conduct and determine whether criminal charges should be brought.

Probable Cause

A legal standard that requires a reasonable basis to believe a person has committed a crime, used in issuing warrants and arrests.

Suspect Committed Crime

The allegation or belief that an individual is responsible for committing a criminal act, often the preliminary step in a legal investigation.

Q8: Daniel's cabin was destroyed in a massive

Q10: Juan has $1,000 that he would like

Q20: Grace has AGI of $60,000 in 2016

Q28: Michelle purchased her home for $150,000,and subsequently

Q36: Jim has $1,000 income from his job

Q45: Alan,who is a security officer,is shot while

Q49: One of the considerations in determining your

Q79: Which of the following statements is incorrect

Q88: Interest income would come from earnings on<br>A)stocks.<br>B)savings

Q148: Generally,50% of the cost of business gifts