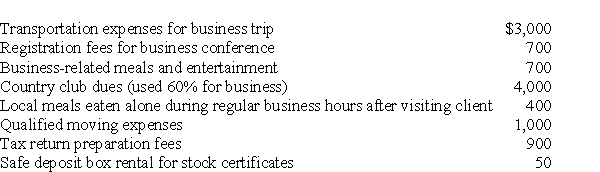

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Negative Goodwill

A situation that occurs when the purchase price of a company is less than the fair value of its net assets, often recognized as a gain in the acquirer's profit and loss account.

Identifiable Net Assets

Assets of an acquired company that can be assigned a fair value and are capable of being separated or divided from the entity for recognition during an acquisition.

Contingent Consideration

Contingent consideration refers to a payment that may be required in the future, the amount of which depends on certain events or conditions that may or may not happen.

Fair Value

The estimated price at which an asset or liability could be traded in an arm's length transaction between informed, willing parties.

Q33: A stream of equal payments either received

Q41: Nina includes the following expenses in her

Q47: Most Americans will never be able to

Q53: Which of the following statements is not

Q63: Cash outflows are also called<br>A)assets.<br>B)expenses.<br>C)income.<br>D)liabilities.

Q71: For purposes of the application of the

Q107: Before consideration of stock sales,Rex has generated

Q115: Jamie sells investment real estate for $80,000,resulting

Q143: On July 1 of the current year,Marcia

Q147: Allison,who is single,incurred $4,000 for unreimbursed employee