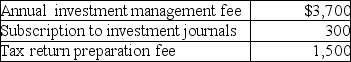

Nina includes the following expenses in her miscellaneous itemized deductions before application of the 2% of AGI floor:  Nina's AGI is $100,000.How much of the above-noted expenses will reduce her net investment income?

Nina's AGI is $100,000.How much of the above-noted expenses will reduce her net investment income?

Definitions:

Drug Addicts

individuals who are dependent on drugs, where such usage negatively affects their physical and mental health, and social relationships.

Alcoholics

individuals who suffer from alcoholism, characterized by a physical or psychological dependency on alcoholic substances.

Substance Abuse

The harmful or hazardous use of psychoactive substances, including alcohol and illicit drugs, leading to addiction or dependency.

Self-Confidence

The belief in one's abilities, qualities, and judgment, empowering them to face challenges with assurance.

Q35: Jerry has assets of $200,000,a net worth

Q39: Ted pays $2,100 interest on his automobile

Q58: A partnership plans to set up a

Q59: Mr.and Mrs.Thibodeaux (both age 35),who are filing

Q70: What factors are considered in determining whether

Q77: Many exclusions exist due to the benevolence

Q102: Gains and losses are recognized when property

Q105: Stacy,who is married and sole shareholder of

Q126: A medical expense is generally deductible only

Q131: During the current year,Tony purchased new car