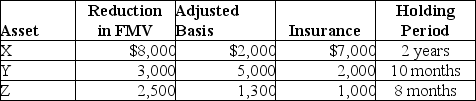

In the current year,Marcus reports the following casualty gains and losses on personal-use property.Assets X and Y are destroyed in the first casualty while Z is destroyed in a second casualty.  As a result of these losses and insurance recoveries,Marcus must report

As a result of these losses and insurance recoveries,Marcus must report

Definitions:

Accrued Revenue

Revenue earned but not yet received or recorded at the end of an accounting period.

Fees Earned

Revenue generated from services provided by a business during a specific period.

Accounts Receivable

This refers to the money owed to a company by its customers for goods or services that have been delivered but not yet paid for.

Contra Expense Account

An account that is offset against an expense account on the income statement, effectively reducing the total expense reported.

Q3: Which of the following is not a

Q21: To be tax deductible by an accrual-basis

Q38: Corporate charitable deductions are limited to 10%

Q53: An individual taxpayer who is not a

Q57: Property such as a person's home,car,and furniture

Q66: Candice owns a mutual fund that reinvests

Q73: Jack is 35 years old and is

Q95: Dana purchased an asset from her brother

Q114: Chen had the following capital asset transactions

Q124: Which of the following statements is incorrect