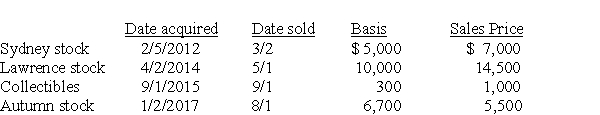

Chen had the following capital asset transactions during 2017:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Definitions:

Virtual Meeting

A meeting conducted via electronic means, where participants interact through video, audio, or text-based platforms, without being physically present in the same location.

Wider Pool

A larger selection or variety of options or candidates.

Mobile Device

A portable computing device such as a smartphone or tablet, designed for easy transportation and use on the move.

Unrelated Tasks

Activities or duties that do not have a direct connection or relevance to the current primary objectives.

Q36: What are some factors which indicate that

Q86: Taxpayers are allowed to recognize net passive

Q102: Gains and losses are recognized when property

Q102: Kevin is a single person who earns

Q105: Generally,deductions for (not from)adjusted gross income are

Q121: Myriah earns salary of $80,000 and $20,000

Q121: Kate is single and a homeowner.In 2017,she

Q126: If an individual taxpayer's net long-term capital

Q131: You may choose married filing jointly as

Q144: Section 1221 of the Code includes a