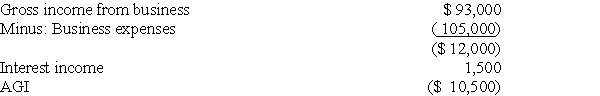

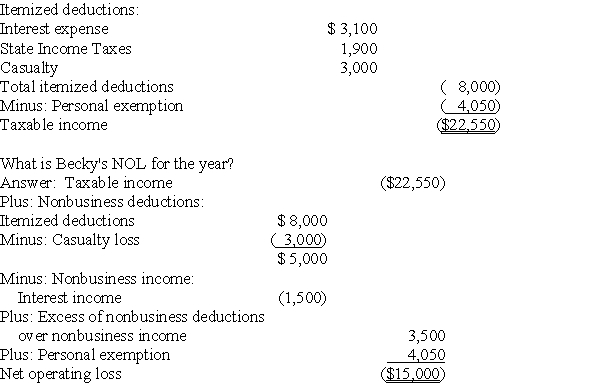

Becky,a single individual,reports the following taxable items in 2017:

Definitions:

Disabilities

Conditions that restrict a person's mental, physical, or sensory abilities, affecting their daily activities and interactions.

Myocardial Infarction

A serious medical condition caused by the blockage of blood flow to the heart muscle, leading to tissue damage or death, commonly known as a heart attack.

Cardiovascular Function

The ability of the heart and blood vessels to circulate blood throughout the body, delivering oxygen and nutrients to tissues.

Chronic Lung Disease

A group of long-term respiratory conditions that block airflow and make it difficult to breathe.

Q6: A personal financial plan specifies financial goals

Q24: A(n)_ is a forecast of your future

Q27: The maximum tax deductible contribution to a

Q28: Van pays the following medical expenses this

Q53: Jeffrey,a T.V.news anchor,is concerned about the wrinkles

Q54: Alex is a self-employed dentist who operates

Q67: Cash outflows represent your liabilities such as

Q96: Under a qualified pension plan,the employer's deduction

Q99: Investment interest expense is deductible when incurred

Q118: Allison buys equipment and pays cash of