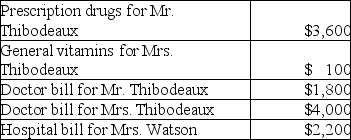

Mr.and Mrs.Thibodeaux (both age 35) ,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Ending Balance

The amount of money in an account at the end of a financial period, after all transactions have been accounted for.

Plan Assets

The resources set aside to pay employee benefits under a pension or other post-employment benefit plan.

Fair Value

Rephrased: An accounting concept referring to the estimated price at which an asset could be bought or sold in a current transaction between willing parties.

Expected Pension Benefits

Expected pension benefits represent the future payments an employee has earned under a pension plan, based on factors like years of service and salary history.

Q9: Mr.and Mrs.Gere,who are filing a joint return,have

Q36: What are some factors which indicate that

Q39: Losses on sales of property between a

Q54: Alex is a self-employed dentist who operates

Q62: The act of determining how wealth will

Q77: When a person owns corporate stocks,government or

Q92: An electronics store sold a home theater

Q111: Investment interest expense which is disallowed because

Q127: Nikki is a single taxpayer who owns

Q132: Net long-term capital gains receive preferential tax