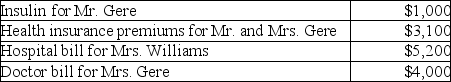

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Overconfidence

A cognitive bias characterized by an individual's overestimation of their knowledge, ability, or access to information.

Cross-examining

The process of questioning a witness who has already testified in order to test or check the accuracy of that testimony.

Eyewitness

An individual who directly observes an event or crime and can provide testimony or information regarding what they saw.

Aggressive

Characterized by or showing readiness or strong inclination to act in a way that intends to dominate or harm others physically or verbally.

Q1: Ola owns a cottage at the beach.She

Q16: If a medical expense reimbursement is received

Q21: To be tax deductible by an accrual-basis

Q24: A(n)_ is a forecast of your future

Q40: A thorough understanding of this personal finance

Q56: Expenditures for long-term care insurance premiums qualify

Q57: Margaret died on September 16,2017,when she owned

Q72: Lisa loans her friend,Grace,$10,000 to finance a

Q75: Tia is a 52-year-old,unmarried taxpayer who is

Q95: Medical expenses are deductible as a from