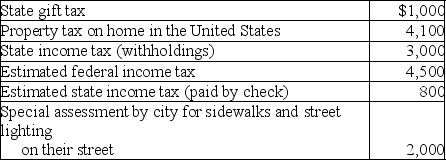

During the year Jason and Kristi,cash-basis taxpayers,paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

Definitions:

Biological Specimens

Samples of biological material, such as blood, tissues, or cells, used for diagnostic, research, or teaching purposes.

Pathogens

Microorganisms that cause disease in hosts, including bacteria, viruses, fungi, and parasites.

HBV (Hepatitis B Virus)

A serious liver infection caused by the hepatitis B virus that can become chronic and lead to liver failure, cancer, or cirrhosis.

Immunizations

The process of making someone immune to an infection, typically by the administration of vaccines.

Q4: Bob owns 100 shares of ACT Corporation

Q15: Kim currently lives in Buffalo and works

Q18: Paying cash for an Alaskan cruise would<br>A)increase

Q39: Miranda is not a key employee of

Q40: The term "principal place of business" includes

Q45: During the current year,Don's aunt Natalie gave

Q47: Three years ago,Myriah refinanced her home mortgage

Q54: Alex is a self-employed dentist who operates

Q65: Tina,whose marginal tax rate is 33%,has the

Q76: Rick chose the following fringe benefits under