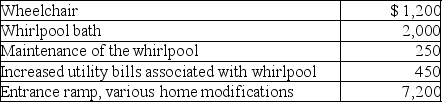

Alan,who is a security officer,is shot while on the job.As a result,Alan suffers from a chronic leg injury and must use a wheelchair and undergo therapy to regain and retain strength.Alan's physician recommends that he install a whirlpool bath in his home for therapy.During the year,Alan makes the following expenditures:  A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

A professional appraiser tells Alan that the whirlpool has increased the value of his home by $1,000.Alan's deductible medical expenses (before considering limitations based on AGI) will be

Definitions:

James-Lange Theory

A theory of emotion suggesting that emotions occur as a result of physiological reactions to events.

Emotion

A complex psychological state that involves a subjective experience, physiological response, and behavioral or expressive reaction.

James-Lange Theory

A theory of emotion proposing that emotions occur as a result of physiological reactions to events, suggesting that bodily responses precede and drive the emotional experience.

Autonomic Response

Involuntary bodily functions controlled by the autonomic nervous system, such as heart rate, digestion, and respiratory rate.

Q21: An understanding of personal finance is not

Q36: Jim has $1,000 income from his job

Q39: On July 25,2016,Karen gives stock with a

Q52: Medical expenses incurred on behalf of children

Q58: Harley,a single individual,provided you with the following

Q62: Which of the following is not excluded

Q64: In a defined contribution pension plan,fixed amounts

Q68: Joe is a self-employed tax attorney who

Q125: During the year Jason and Kristi,cash-basis taxpayers,paid

Q134: On July 25,2016,Marilyn gives stock with a