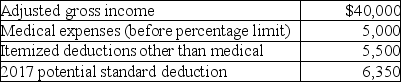

A review of the 2017 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2017 tax status:  In 2018,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2018,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

Connect

To establish a relationship or a link between people, objects, systems, or information, often facilitating communication, interaction, or access.

Privacy Salience

The extent to which privacy considerations are prominent or important to an individual, often influencing behavior and attitudes towards information sharing and protection.

Unauthorized Secondary Use

The use of data or information for purposes different from those originally intended or authorized, without permission.

Personal Data

Information related to an identifiable individual, including details that can be used on their own or with other information to identify, contact, or locate a person.

Q8: Daniel's cabin was destroyed in a massive

Q13: Vanessa owns a houseboat on Lake Las

Q16: If a medical expense reimbursement is received

Q20: Which of the following items is not

Q49: Discuss what circumstances must be met for

Q50: Clarissa is a very successful real estate

Q61: A theft loss is deducted in the

Q62: The act of determining how wealth will

Q87: A personal balance sheet presents<br>A)amounts budgeted for

Q114: Chen had the following capital asset transactions