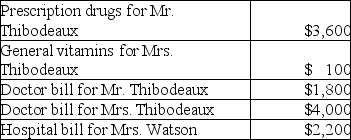

Mr.and Mrs.Thibodeaux (both age 35) ,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Electrolyte

A substance that produces an electrically conducting solution when dissolved in water, important in many biological processes.

Electrolyte

A compound that forms an electrically conductive solution upon being dissolved in a polar solvent, like water.

NaI

Sodium iodide, an ionic compound often used in organic synthesis and as a supplement.

KBr

Potassium bromide, a chemical compound consisting of potassium (K) and bromine (Br), used mainly in photography and in medication.

Q2: Which of the following actions will not

Q27: During his _ your Uncle Harvey decides

Q41: Gambling losses are miscellaneous itemized deductions subject

Q45: How is a claim for refund of

Q51: In 2015 Betty loaned her son,Juan,$10,000 to

Q59: The amount of cash fringe benefits received

Q75: Liabilities can be calculated by<br>A)adding assets plus

Q80: Which of the following decisions would involve

Q115: Finance charges on personal credit cards are

Q129: Dighi,an artist,uses a room in his home