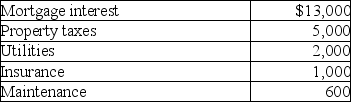

Ola owns a cottage at the beach.She and her family use the property for 30 days during the summer season and rent it to unrelated parties for 60 days.The rental receipts amount to $8,000.Total costs of operating the property are as follows:

In addition,potential depreciation expense is $9,000.

In addition,potential depreciation expense is $9,000.

a.Is the cottage subject to the vacation home rental limitations of IRC Sec.280A?

b.How much of expenses can Ola deduct?

Definitions:

Market Price

The current price at which an asset or service can be bought or sold in a public market.

Return On Total Assets

A financial ratio that measures a company's ability to generate earnings from its assets, calculated by dividing net income by total assets.

Market Price

The present cost at which a service or asset is available for purchase or sale in the market.

Common Stock

Represents ownership shares in a corporation, giving holders voting rights and a share in the company's profits through dividends.

Q8: Sean and Martha are both over age

Q25: Tim earns a salary of $40,000.This year,Tim's

Q31: If Houston Printing Co.purchases a new printing

Q41: All of the following are true of

Q84: Jarrett owns a mountain chalet that he

Q92: Tasneem,a single taxpayer has paid the following

Q102: Abby owns a condominium in the Great

Q107: Before consideration of stock sales,Rex has generated

Q108: Teri pays the following interest expenses during

Q130: Jing,who is single,paid educational expenses of $16,000