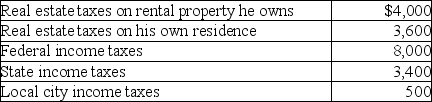

Arun paid the following taxes this year:  What amount can Arun deduct as an itemized deduction on his tax return?

What amount can Arun deduct as an itemized deduction on his tax return?

Definitions:

Infant

A very young child or baby, typically under one year of age.

Konrad Lorenz

An Austrian zoologist and ethologist known for his foundational work in animal behavior studies, particularly imprinting.

Imprinting

A rapid learning process occurring soon after birth in certain animals, where they form attachments and develop certain behaviors typically towards their parents or an object.

Goslings

Young geese that have not yet reached maturity.

Q30: The income in your budget is not

Q31: If Houston Printing Co.purchases a new printing

Q31: Mickey has a rare blood type and

Q56: One of the requirements which must be

Q72: The best measure of a person's or

Q88: To increase your savings,<br>A)income must be increased.<br>B)expenses

Q100: Mike,a dealer in securities and calendar-year taxpayer,purchased

Q121: The following taxes are deductible as itemized

Q141: Deferred compensation refers to methods of compensating

Q144: Section 1221 of the Code includes a