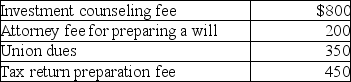

Daniel had adjusted gross income of $60,000,which consisted of $55,000 in wages and $5,000 in dividend income from taxable domestic corporations.His expenses include:  What is the net amount deductible by Daniel for the above items?

What is the net amount deductible by Daniel for the above items?

Definitions:

Q16: A passive activity includes any rental activity

Q46: Deductions for adjusted gross income include all

Q51: Hobby expenses are deductible as for AGI

Q54: Which of the following would not be

Q75: Melanie,a single taxpayer,has AGI of $220,000 which

Q75: Leslie,who is single,finished graduate school this year

Q78: Jordan paid $30,000 for equipment two years

Q84: Bill obtained a new job in Boston.He

Q117: Patrick's records for the current year contain

Q133: Employees receiving nonqualified stock options recognize ordinary