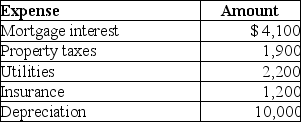

Abby owns a condominium in the Great Smokey Mountains.During the year,Abby uses the condo a total of 21 days.The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500.Abby incurs the following expenses:  Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Using the IRS method of allocating expenses,the amount of depreciation that Abby may take with respect to the rental property will be

Definitions:

FICA Tax Rate

The combined rate for Social Security and Medicare taxes that both employers and employees pay, based on a percentage of employees' wages.

Unemployment Taxes

Taxes that employers are required to pay to the government, which are used to fund unemployment benefits for workers who have lost their jobs.

Overtime Pay

Additional compensation paid to employees for hours worked beyond the standard workweek.

Payroll Register

A record that summarizes the wages, deductions, and net pay of all employees for each pay period.

Q20: The following information is available for Bob

Q24: Faye earns $100,000 of AGI,including $90,000 of

Q29: Amanda,whose tax rate is 33%,has NSTCL of

Q63: Anna is supported entirely by her three

Q78: All of the following losses are deductible

Q82: Corner Grocery,Inc. ,a C corporation with high

Q94: Payments from an annuity purchased from an

Q111: Self-employed individuals receive a for AGI deduction

Q141: An individual buys 200 shares of General

Q144: Hunter retired last year and will receive