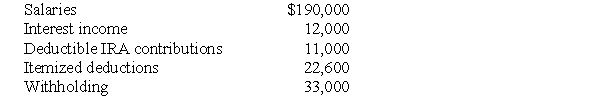

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2017.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax),rounded to the nearest dollar?

e.What is the amount of their tax due or (refund due)?

Definitions:

Q3: Each year a taxpayer must include in

Q26: What are the characteristics of the Pension

Q32: Douglas and Julie are a married couple

Q39: On July 25,2016,Karen gives stock with a

Q47: Three years ago,Myriah refinanced her home mortgage

Q88: The transfer of property to a partnership

Q103: Amanda,who lost her modeling job,sued her employer

Q118: For a cash-basis taxpayer,security deposits received on

Q122: Individuals Gayle and Marcus form GM Corporation.Gayle

Q147: James and Sharon form an equal partnership