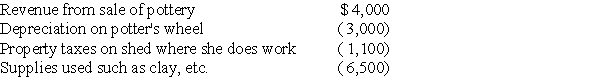

Margaret,a single taxpayer,operates a small pottery activity in her spare time.During the current year,she reported the following income and expenses from this activity which is classified as a hobby:

In addition,she had salary of $75,000 and itemized deductions,not including those listed above,of $2,200.

In addition,she had salary of $75,000 and itemized deductions,not including those listed above,of $2,200.

What is the amount of her taxable income?

Definitions:

Cultures

The customs, arts, social institutions, and achievements of a particular nation, people, or other social group.

Purposes

The reasons for which something is done or created or for which something exists.

Folklore

Traditional beliefs, customs, stories, songs, and practices that are passed through generations by word of mouth.

Battle Scenes

Depictions of combat in visual, literary, or auditory media, highlighting the drama of conflict.

Q1: The sale of inventory at a loss

Q32: Frank and Marion,husband and wife,file separate returns.Frank

Q36: What are some factors which indicate that

Q54: Leonard owns a hotel which was damaged

Q55: A sole proprietor paid legal fees in

Q57: Chad and Jaqueline are married and have

Q73: An unmarried taxpayer may file as head

Q88: Max sold the following capital assets this

Q100: The portion of a taxpayer's wages that

Q116: A check received after banking hours is