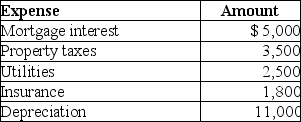

Mackensie owns a condominium in the Rocky Mountains.During the year,Mackensie uses the condo a total of 23 days.The condo is also rented to tourists for a total of 77 days and generates rental income of $10,900.Mackensie incurs the following expenses in the condo:  Using the court's method of allocating expenses,the amount of depreciation that Mackensie may take with respect to the rental property will be

Using the court's method of allocating expenses,the amount of depreciation that Mackensie may take with respect to the rental property will be

Definitions:

Self-interest

Acting in a way that is beneficial to oneself, often based on personal gain or advantage.

Economic-interest

Refers to the set of financial or commercial objectives and incentives that motivate individuals, organizations, or nations.

Organizational Process Model

A framework for understanding how an organization operates through a series of actions or steps to achieve its goals.

Predetermined Vision

A future-oriented statement or concept that has been deliberately set in advance, guiding decision-making and goal-setting.

Q25: Business investigation expenses incurred by a taxpayer

Q39: Losses incurred in the sale or exchange

Q54: Randy and Sharon are married and have

Q64: Aaron found a prototype of a new

Q93: Amounts collected under accident and health insurance

Q101: All casualty loss deductions,regardless of the type

Q106: A single individual with no dependents can

Q118: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q125: A taxpayer incurs a net operating loss

Q130: Jing,who is single,paid educational expenses of $16,000