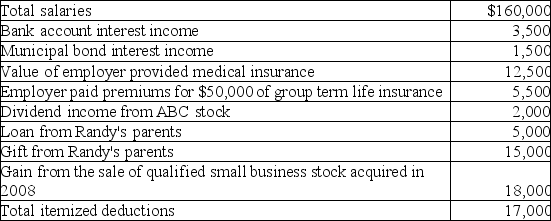

Randy and Sharon are married and have two dependent children.Their 2017 tax and other related information is as follows:

Compute Randy and Sharon's taxable income.(Show all calculations in good form. )

Compute Randy and Sharon's taxable income.(Show all calculations in good form. )

Definitions:

Buyers

Individuals or entities that purchase goods or services for personal use, resale, or use in production or operations.

Choices

The range of different options or decisions available to an individual or organization.

Rivalry

The competitive relationship between businesses in the same industry, aiming to achieve higher sales, market share, and customer loyalty.

Competition

A scenario where two or more parties strive for a common goal which cannot be shared, such as market share, victory in a sport, or the acquisition of a contract.

Q1: Jamal,age 52,is a human resources manager for

Q2: A taxpayer reports capital gains and losses

Q43: Jorge contributes $35,000 to his church and

Q57: Which of the following is a classic

Q67: Which of the following is not required

Q78: Jordan paid $30,000 for equipment two years

Q102: Kevin is a single person who earns

Q111: Doug,a self-employed consultant,has been a firm believer

Q133: In 2017,the standard deduction for a married

Q145: Eugene,a hardware store owner in Detroit,incurs $7,000