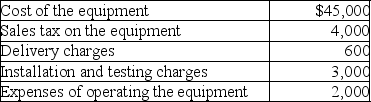

During the current year,Tony purchased new car wash equipment for use in his service station business.Tony's costs in connection with the new equipment this year were as follows:  What is Tony's basis in the car wash equipment?

What is Tony's basis in the car wash equipment?

Definitions:

Newborn

A baby from birth to about 2 months of age, characterized by rapid physical and sensory development.

Common Vegetable

A widely consumed plant or part of a plant, typically used in cooking as part of a healthy diet.

Babies

Very young infants, typically understood to be in the first year of life.

French Fries

Deep-fried potato strips, often salted, and served as a side dish or snack.

Q2: Individual taxpayers can offset portfolio income with

Q32: Frank and Marion,husband and wife,file separate returns.Frank

Q76: The amount realized by Matt on the

Q85: Gabby owns and operates a part-time art

Q94: Ella is a cash-basis sole proprietor providing

Q100: All of the following are requirements for

Q104: Which of the following is most likely

Q126: If an individual taxpayer's net long-term capital

Q128: For non-cash charitable donations,an appraisal will be

Q149: The regular standard deduction is available to