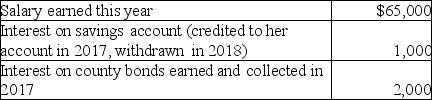

Ms.Marple's books and records for 2017 reflect the following information:  What is the amount Ms.Marple should include in her gross income in 2017?

What is the amount Ms.Marple should include in her gross income in 2017?

Definitions:

Hypothalamus

A region of the brain that regulates many bodily functions, including hunger, thirst, temperature, and the release of hormones.

Pituitary

A small gland at the base of the brain that regulates growth, metabolism, and the function of other glands in the endocrine system.

Sleep-Wake Shift

A change or disruption in the normal sleep cycle, often referring to alterations in the timing of sleep due to various factors such as work schedule changes, travel, or health conditions.

Biological Clock

An internal mechanism in living organisms that controls the cycle of biological activities and processes.

Q11: For purposes of calculating depreciation,property converted from

Q24: For the years 2013 through 2017 (inclusive)Max,a

Q45: Adam attended college for much of 2017,during

Q49: Marcia and Dave are separated and negotiating

Q68: Richard exchanges a building with a basis

Q90: The gain or loss on an asset

Q90: On December 1,Robert,a cash-method taxpayer,borrows $10,000 from

Q102: Abby owns a condominium in the Great

Q113: Guaranteed payments are not deductible by the

Q116: Taxpayers have the choice of claiming either