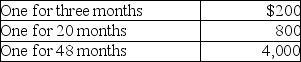

CT Computer Corporation,a cash-basis taxpayer,sells service contracts on the computers it sells.At the beginning of January of this year,CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

Definitions:

Phonemes

The smallest units of sound in a language that can distinguish one word from another.

Decoding

The ability to interpret or translate a sequence of symbols (such as letters and words) into meaningful information.

Phonological Awareness

The ability to recognize and manipulate sounds in language, a critical foundational skill for reading and spelling.

Agrarian Societies

Societies primarily engaged in agriculture, with most of the economy based on farming and land cultivation.

Q17: Lindsay Corporation made the following payments to

Q19: The basis of a partner's interest in

Q23: One characteristic of the Pension Model is

Q28: Carl filed his tax return,properly claiming the

Q29: Expenses attributable to the rental use of

Q60: Over the years Rianna paid $65,000 in

Q114: Chen had the following capital asset transactions

Q120: A partnership is generally required to use

Q129: Emma Grace acquires three machines for $80,000,which

Q145: Amanda has two dependent children,ages 10 and