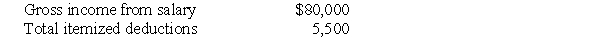

Steve Greene,age 66,is divorced with no dependents.In 2017 Steve had income and expenses as follows:

Compute Steve's taxable income for 2017.Show all calculations.

Compute Steve's taxable income for 2017.Show all calculations.

Definitions:

Organization Structure

The system of roles, responsibilities, and relationships within an organization that determines how it operates and makes decisions.

Reporting Relationships

The formal lines of authority and communication within an organization, indicating who reports to whom.

Communication Channels

The mediums through which information is transmitted from one entity to another, including verbal, non-verbal, written, and electronic means.

Divisional Structure

An organization structure that groups together people working on the same product, in the same area, with similar customers, or on the same processes.

Q1: To be considered a Section 1202 gain,the

Q19: Rebecca is the beneficiary of a $500,000

Q23: A CPA firm,operating as a partnership,can become

Q47: Given that D<sub>n</sub> is the amount of

Q70: Chocolat Inc.is a U.S.chocolate manufacturer.Its domestic production

Q70: Any distribution from a qualified tuition plan

Q82: Niral is single and provides you with

Q93: Identify which of the following statements is

Q95: In 2017,Sam is single and rents an

Q147: Brett,a single taxpayer with no dependents,earns salary