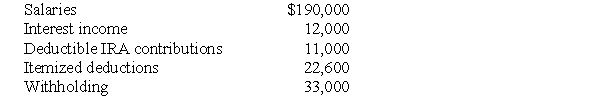

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2017.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax),rounded to the nearest dollar?

e.What is the amount of their tax due or (refund due)?

Definitions:

Migration

The movement of people from one place to another, often across political or economic boundaries, for various reasons including work, education, or escape from conflict.

Living Costs

The necessary expenses that individuals incur in order to maintain a standard of living, including housing, food, taxes, and healthcare.

Expected Gains

Anticipated benefits or profits that are expected from an investment, project, or decision.

Total Wage Bill

The total amount of money paid by an employer to its employees as wages.

Q20: Which of the following benefits provided by

Q31: Which of the following statements is correct,assuming

Q50: On January 31 of the current year,Sophia

Q54: Randy and Sharon are married and have

Q62: On January 1 of this year,Brad purchased

Q77: DAD Partnership has one corporate partner,Domino Corporation,with

Q81: Gabe Corporation,an accrual-basis taxpayer that uses the

Q109: Parents often wish to shift income to

Q130: Ray is starting a new business and

Q138: Rena and Ronald,a married couple,each earn a